Seizing today’s Private Debt opportunity

Market perspective | May 2025

With global markets under pressure from geopolitical conflicts, U.S. tariffs, recession fears, and persistent public market volatility, investors are facing one of the most uncertain environments in recent years. In this climate, Private Debt stands out as a resilient and strategic solution– providing consistent, compounding, contractual income. While typically less liquid than public fixed income, this illiquidity can be a key source of enhanced yield and downside protection.

Short-term dislocation creates entry opportunities in Private Debt

Against the backdrop of global investor uncertainty, market dislocations are opening the door to attractive entry points for selective capital deployment by Private Debt investors:

- Volatility drives debt repricing: The U.S. tariff escalation has caused repricing in debt markets. These dynamics allow investors to access quality assets at better terms.

- Private lenders bridge the funding gap: As banks retreat due to regulatory/macro pressures, Private Debt funds become primary lenders to the middle market, enabling favourable terms.

- Floating-rate loans mitigate inflation risks: Most Private Debt structures are floating-rate, allowing interest to rise with base rates. This provides investors with a built-in inflation hedge.

While dislocation is creating opportunities for private lenders, investors should remain mindful of near-term risks such as slowing growth, rising input costs, and market illiquidity. Yet these very dynamics also set the stage for structural, medium- to long-term advantages of Private Debt.

Medium- to long-term fundamentals reinforce case for Private Debt

Long-term characteristics make Private Debt a resilient and essential portfolio component:

- High, contractual cash income beyond public debt

- Growing market opportunity given structural tailwinds from bank retrenchment

- Crisis resilience and portfolio diversification

1. High, contractual cash income beyond public debt

Historically (between 2001 and 2021), Private Debt has consistently delivered higher total returns and stronger cash income than public debt, while maintaining lower volatility and drawdown risk. These dynamics underscore its value as a defensive, income-generating asset class for investors across the globe.

2. Growing market opportunity given structural tailwinds

Private Debt has grown significantly in the last two decades compared to other (public) debt assets. This shift has been accelerated as traditional banks reduce their lending exposure, particularly towards middle-market borrowers due to banks’ rising capital requirements, protectionist policies, and growing exposure to geopolitical risks.

3. Crisis resilience and portfolio diversification

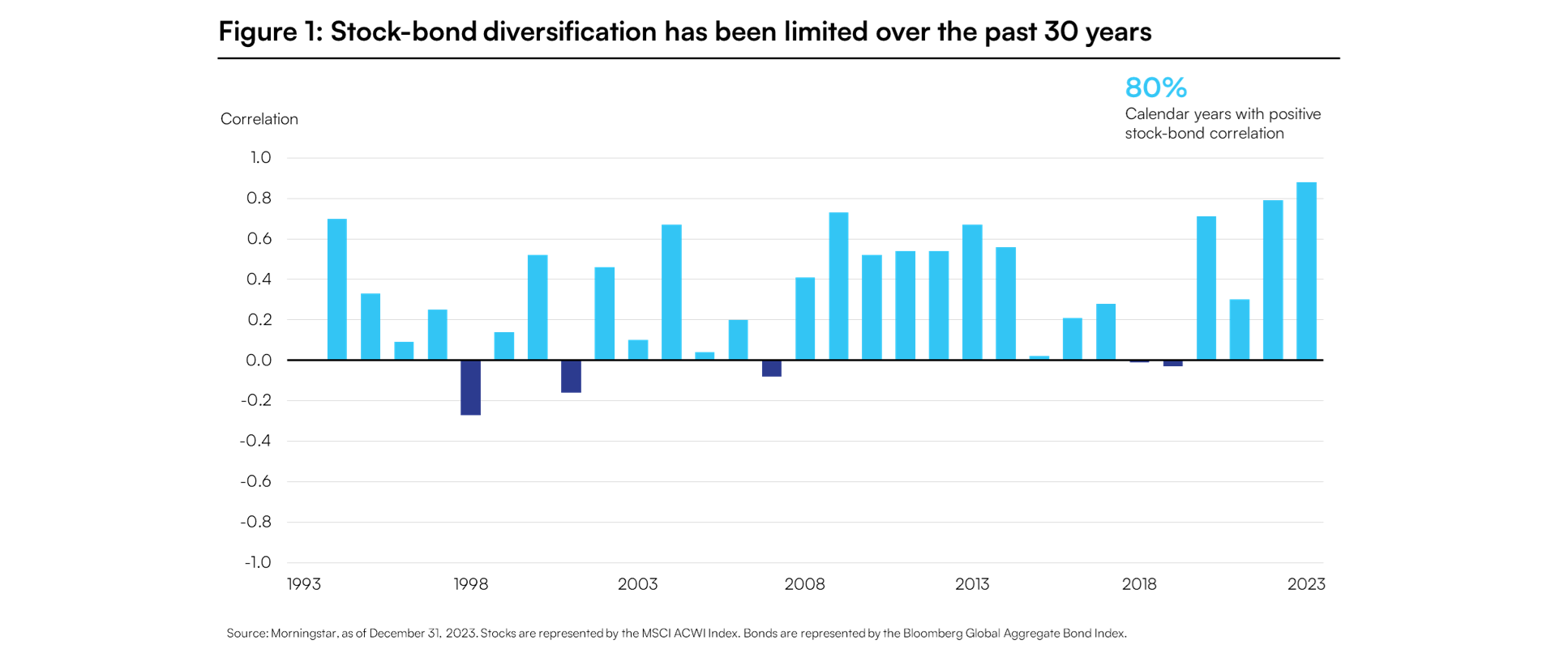

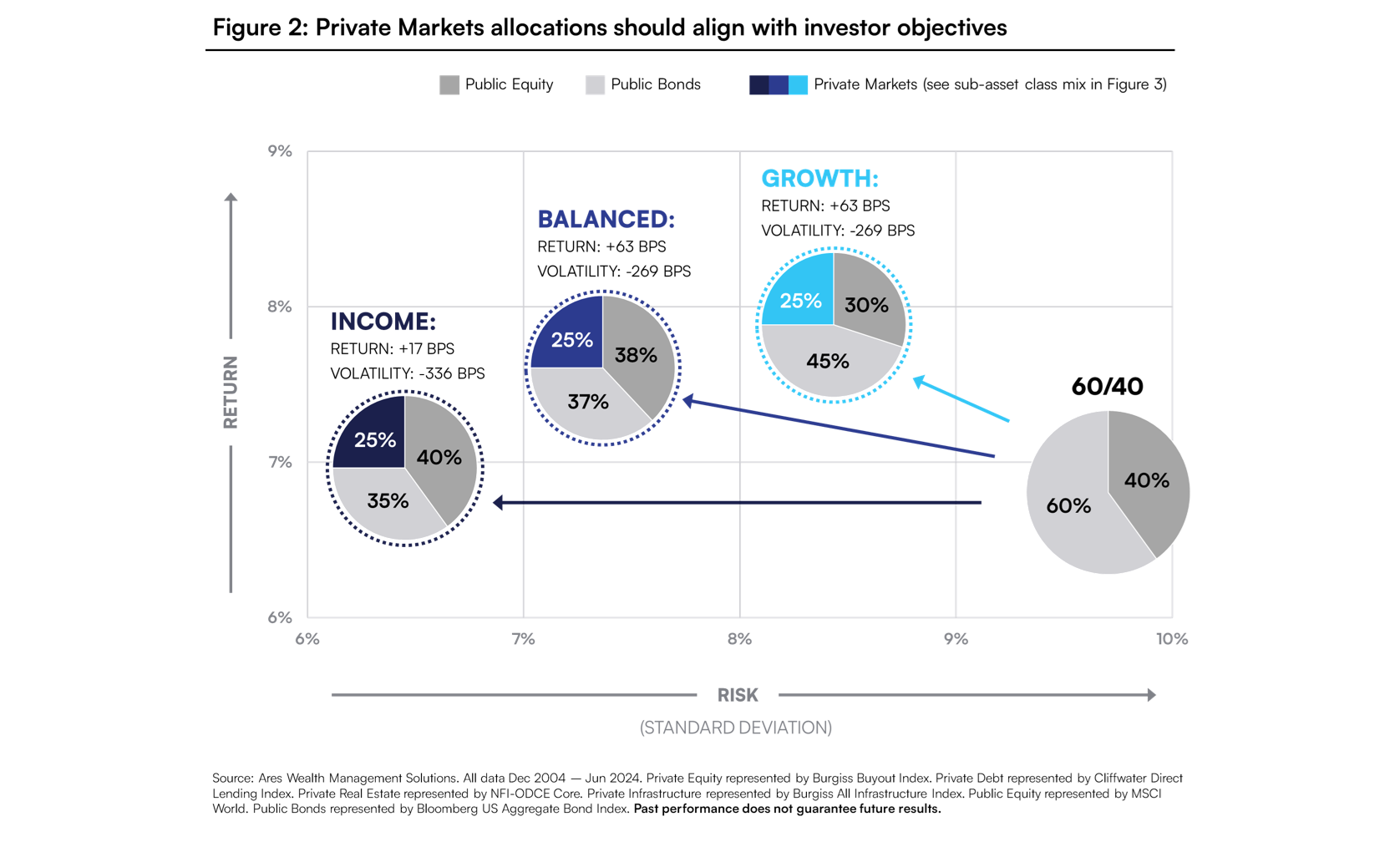

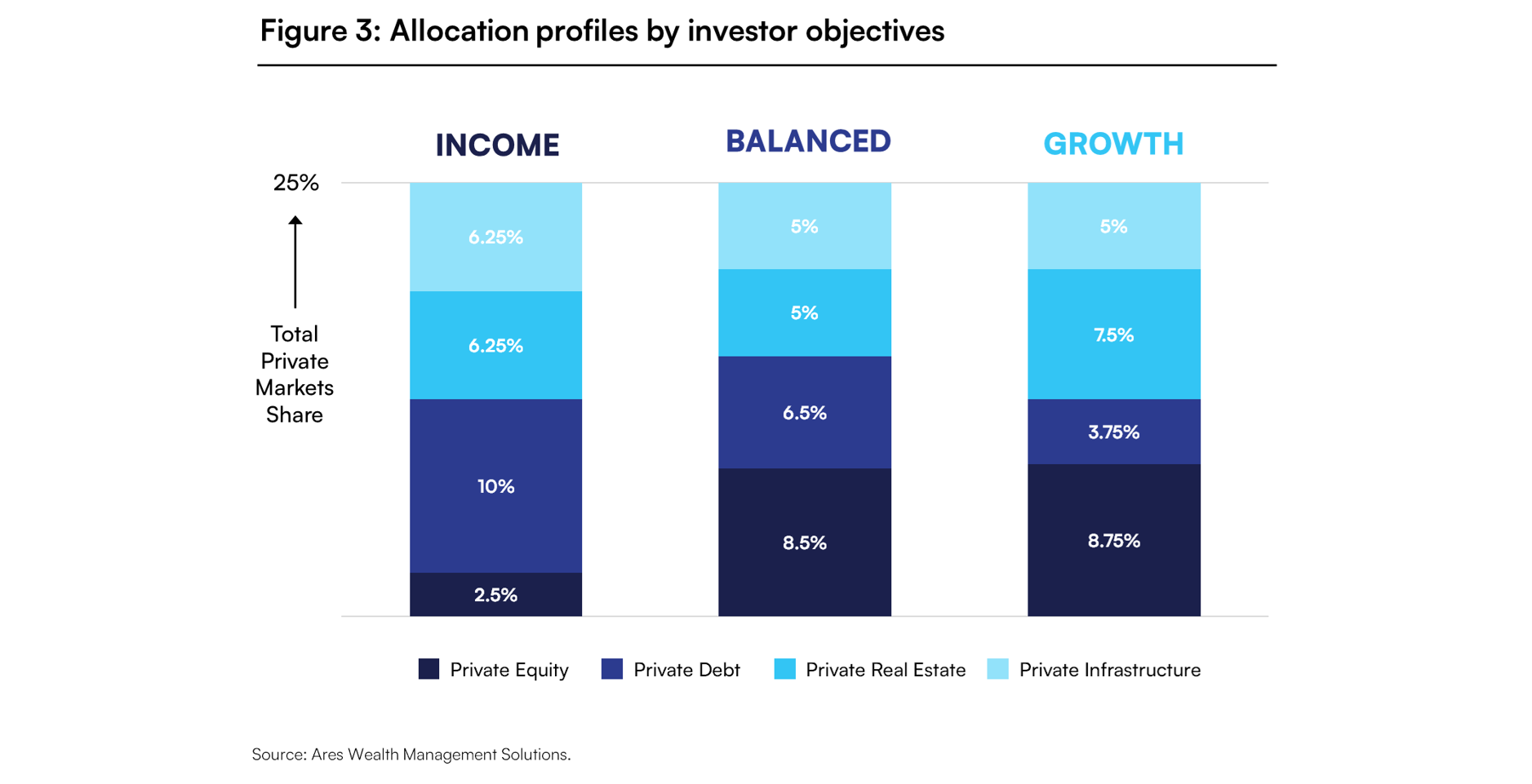

Private Debt has historically had a stabilizing impact on portfolios. The asset class has been significantly less affected by market turbulence and downturns, as seen during the 2008 global financial crisis as well as during the (post-)covid period in 2020/2022. Private Debt is consequently often used by investors as a tool to ensure downside protection and increase portfolio diversification.

In short: Why is now the right time to invest in Private Debt?

Income stability

Private Debt offers predictable, stable cash flows at a time when public markets are fluctuating.

Lending opportunities in liquidity crunch

As banks retreat from certain lending activities, private lenders fill the gap (strong pricing power).

Defensive structure and seniority

Private Debt often entails conservative structures (senior secured), offering protection in downturns

Attractive floating-rate structures

As rates decline, Private Debt compels given floating-rate structures (continued strong yields).

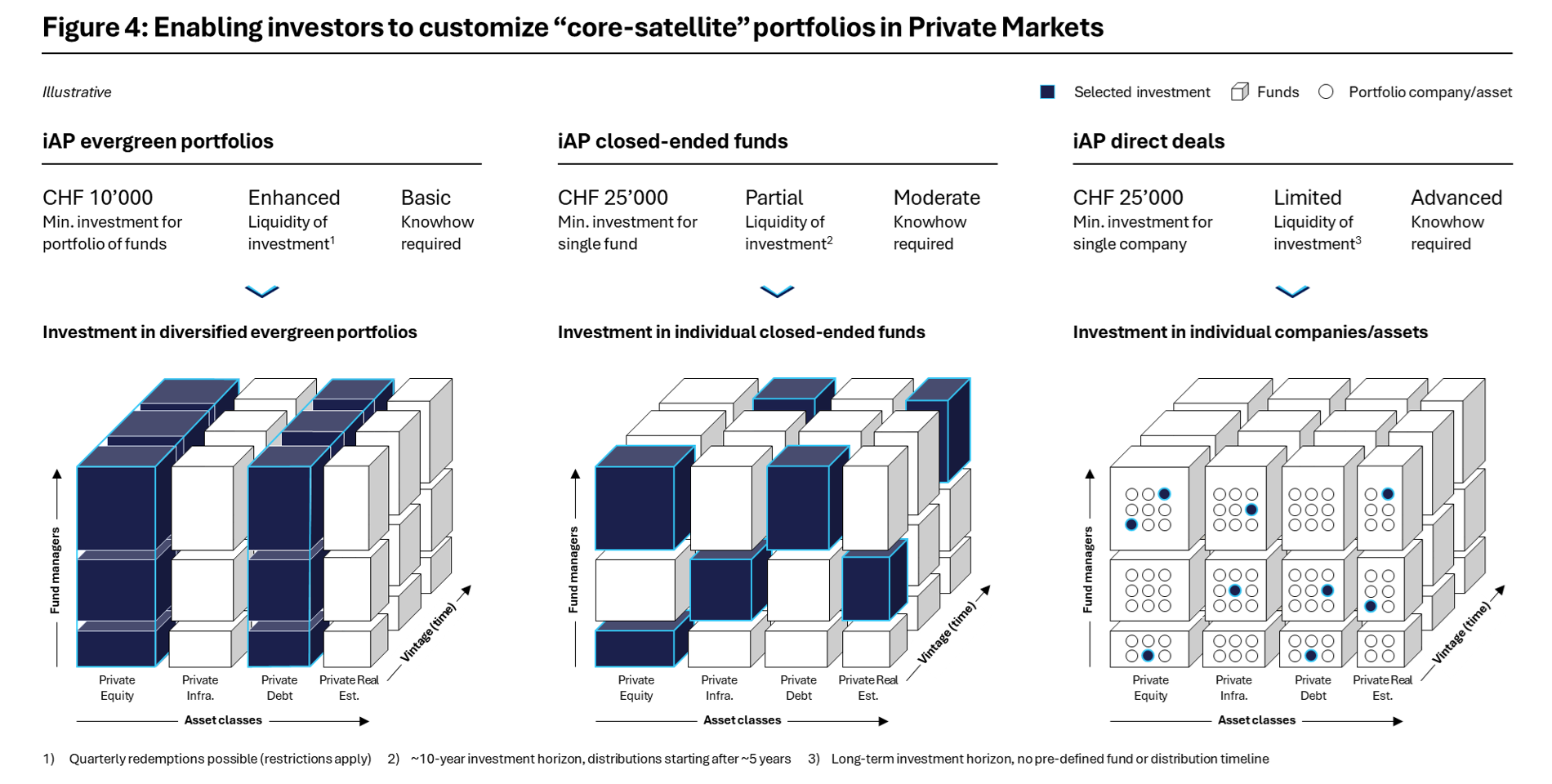

Want to know more about Private Debt or iAccess Partners?

Don’t hesitate to reach out to info@iaccesspartners.com.