Need more information? Contact us!

Reach out to us

Benefits of Private Markets

Private Markets entail two key advantages for investors - historically higher returns (outperformance over Public Markets) and diversification opportunities.

Top-quartile Private Markets funds have historically outperformed Public Markets

“There are no reasons why Private Wealth Investors wouldn’t want to get the same type of positive experience that institutions do.”

Stephen A. Schwarzman, Chairman and CEO Blackstone Group

Portfolio returns with and without Private Markets, indexed

Source: Bloomberg, Cambridge Associates, UBS, Blackstone Public Equity = MSCI ACWI; Public Debt = Bloomberg Global Aggregate; Private Equity = CAPE Global PE.

Past performance is not indicative of future results.

Past performance is not indicative of future results.

The outperformance of Private Markets is evident across all asset classes

“Investors who limit themselves to Public Markets are accessing only a fraction of the investable universe, missing out on opportunities for excess returns.”

EQT Group

Yearly returns across asset classes, 2012-2022

Source: Preqin, Mercer, EQT.

Past performance is not indicative of future results.

Past performance is not indicative of future results.

What drives the overperformance of Private Markets?

Rigorous selection process

Private Markets funds pursue diligent investment processes, selecting <1% of screened companies. This ensures a strict focus on profitable, high-growth companies driving the broader economy.

Source: Russell 2000, Bloomberg, Apollo

Operational value creation

Private Markets funds establish clear roadmaps for operational excellence in their portfolio companies. Over 60% of value created by Private Markets funds is driven by operational improvements.

Source: UBS, EY

Strict governance

Governance in Private Markets is set up to create value through targeted board member selection, unified ownership, aligned interests through compensation, and a pre-defined timeline to exit.

Source: Partners Group, Alix Partners

Entrepreneurial mindset of owners

Private Markets funds are often the main owner of a portfolio company. They carry the risks and benefits in each transaction – and therefore take an active, entrepreneurial role in managing the company.

Source: Partners Group, Alix Partners

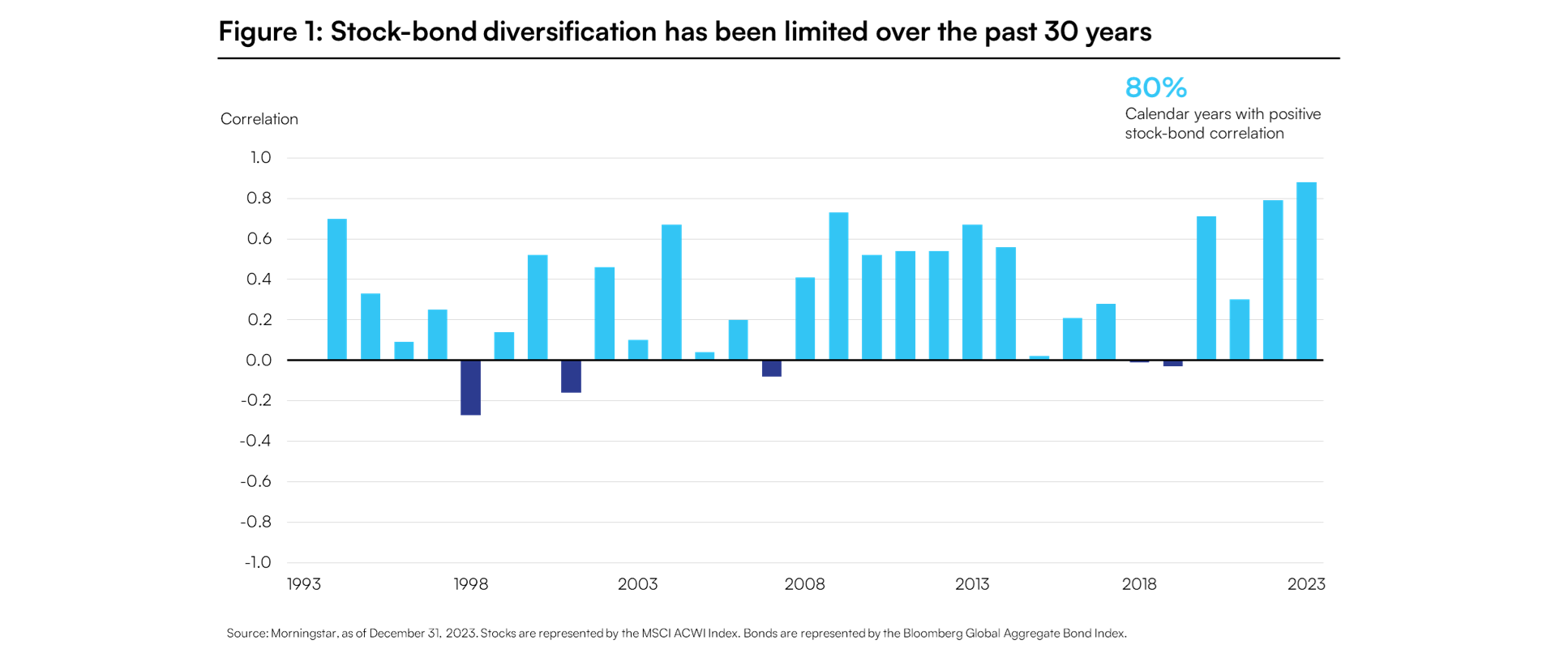

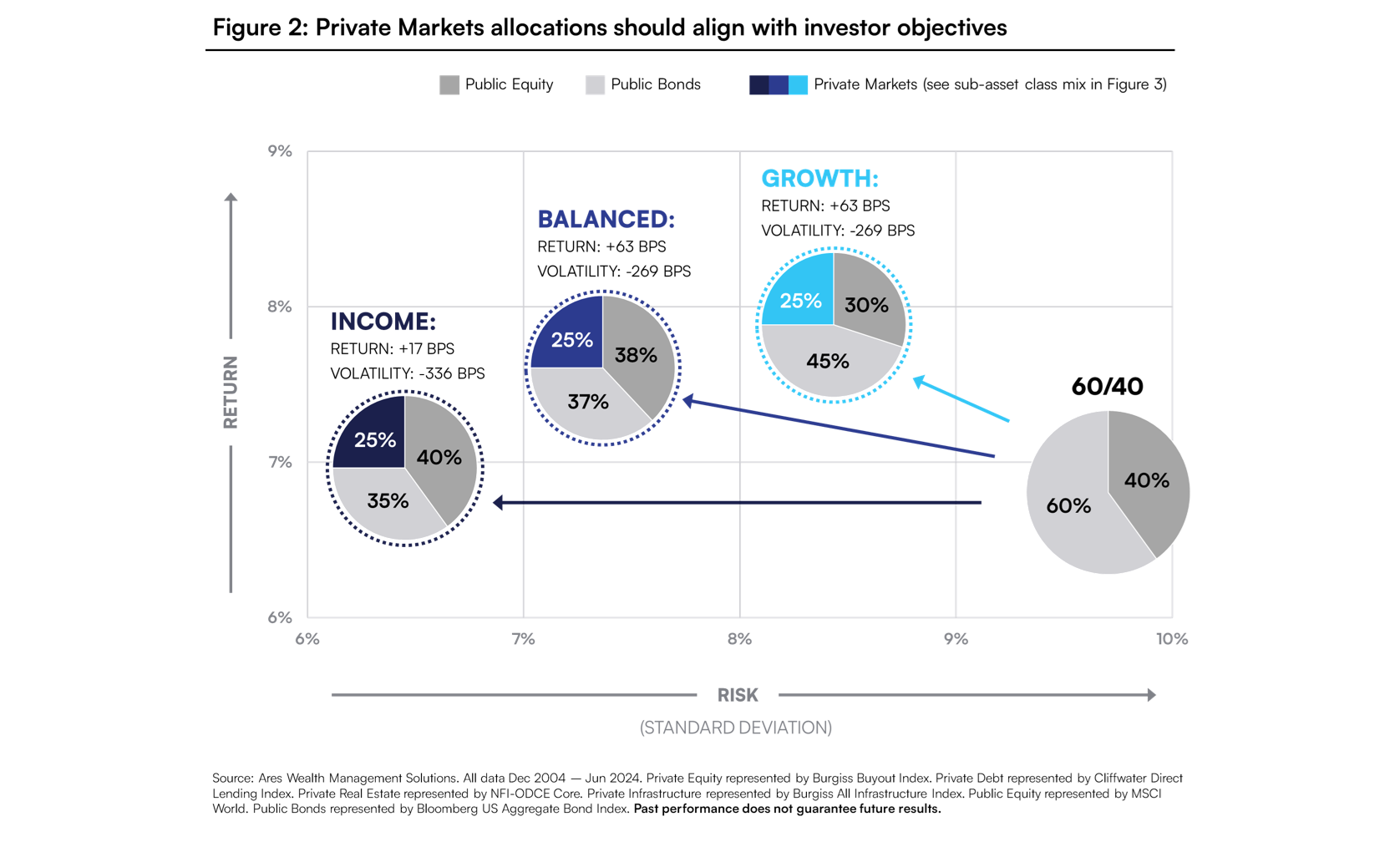

Private Markets investments increase diversification – optimizing the risk/return profile of your portfolio

“The asset class offers attractive opportunities for investors to gain differentiated exposure to long-term opportunities”

UBS Year Ahead 2024

Risk & returns of diversified portfolios, illustrative

Source: Bloomberg, Cambridge Associates, UBS

Past performance is not indicative of future results

Past performance is not indicative of future results

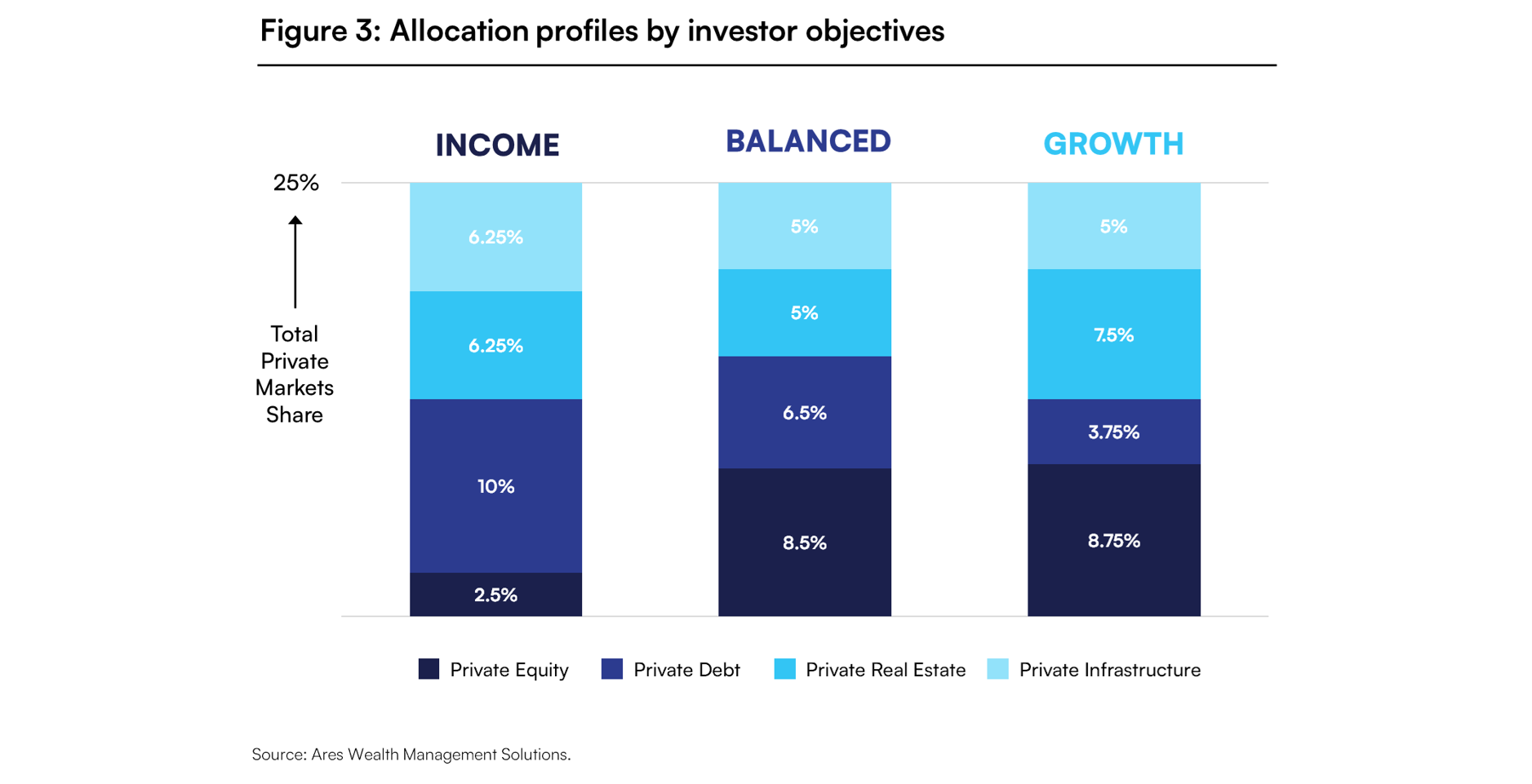

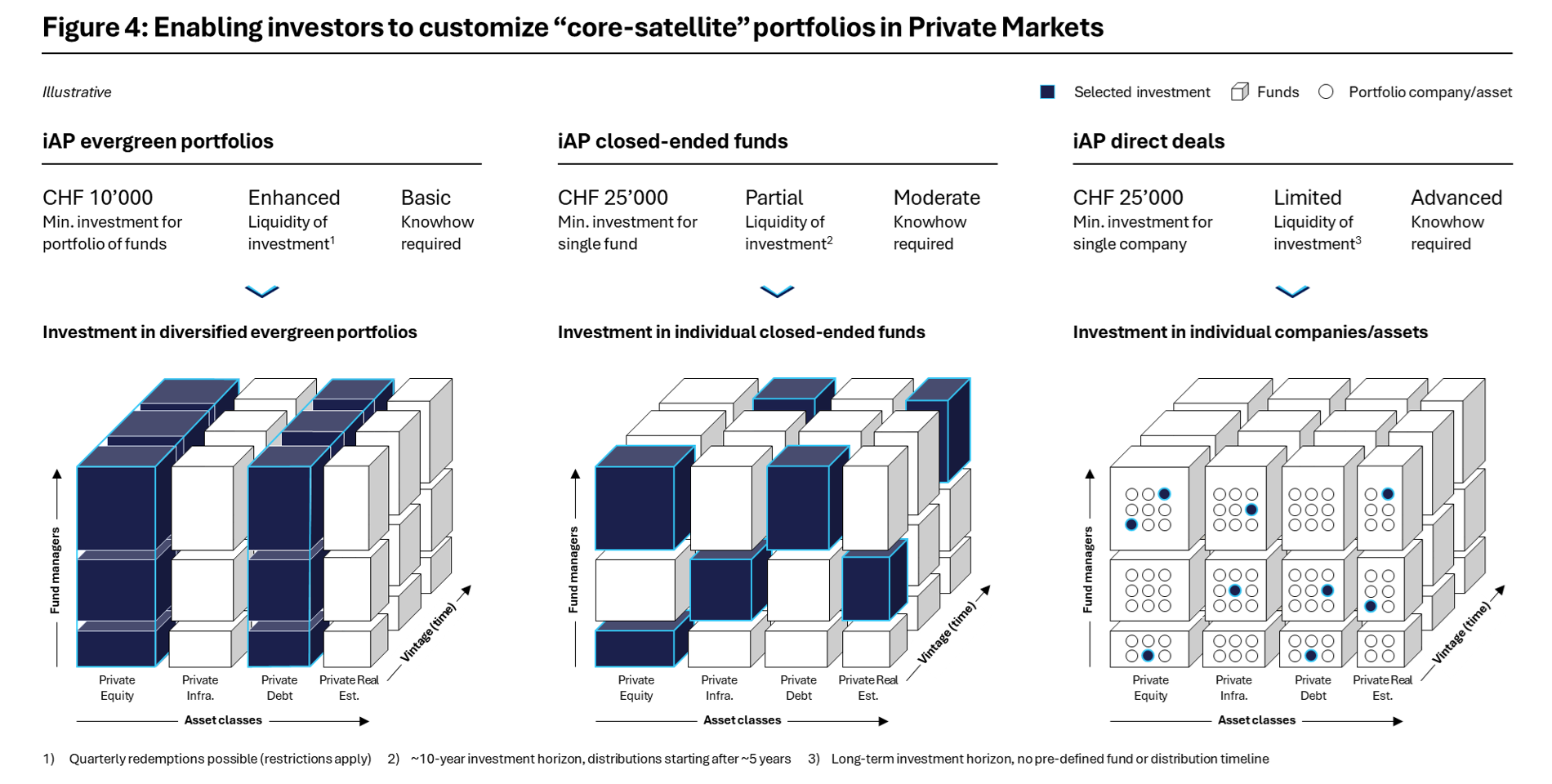

Diversification, fully based on your financial needs

Investments in Private Markets allow for diversification across asset classes, fund managers, vintage (time), and investment size. This enables investors to select investments that precisely match their portfolio needs.

Diversified Private Markets portfolio, illustrative

Want to dive deeper? Check out our industry reports:

Create your account to view our investments

- Free registration

- No obligations

- Fully digital

For qualified professional investors only

Keep up with iAccess Partners

Sign up for our newsletter to learn more about iAccess Partners and investing in Private Markets.

Thank you! Your submission has been received.

You will receive an email for you to confirm your subscription to our newsletter shortly.

Oops! Something went wrong while submitting the form.