Our Private Markets Series (6/6) | Building Your Private Markets Portfolio with iAccess Partners

Read the final episode of our Private Markets series.

Build Your Private Markets Portfolio with iAccess Partners

An iAccess Partners Series: Episode 6/6

After breaking down private investors’ traditional barriers to Private Markets investing in our previous article, our last episode of this series revolves around implementation – building a Private Markets allocation that fits your financial portfolio. We illustrate what a well-balanced portfolio can look like and how different types of private investments can work together.

Key takeaways: Episode 6/6

1. Returns can be enhanced and volatility reduced by effectively integrating Private Markets into financial portfolios.

2. Combining evergreen funds, closed-ended funds, and direct deals can create a balanced and well-diversified Private Markets portfolio.

3. Investors can execute an institutionally inspired “core-satellite” approach with Private Markets investments through iAccess Partners.

Why add Private Markets to your portfolio?

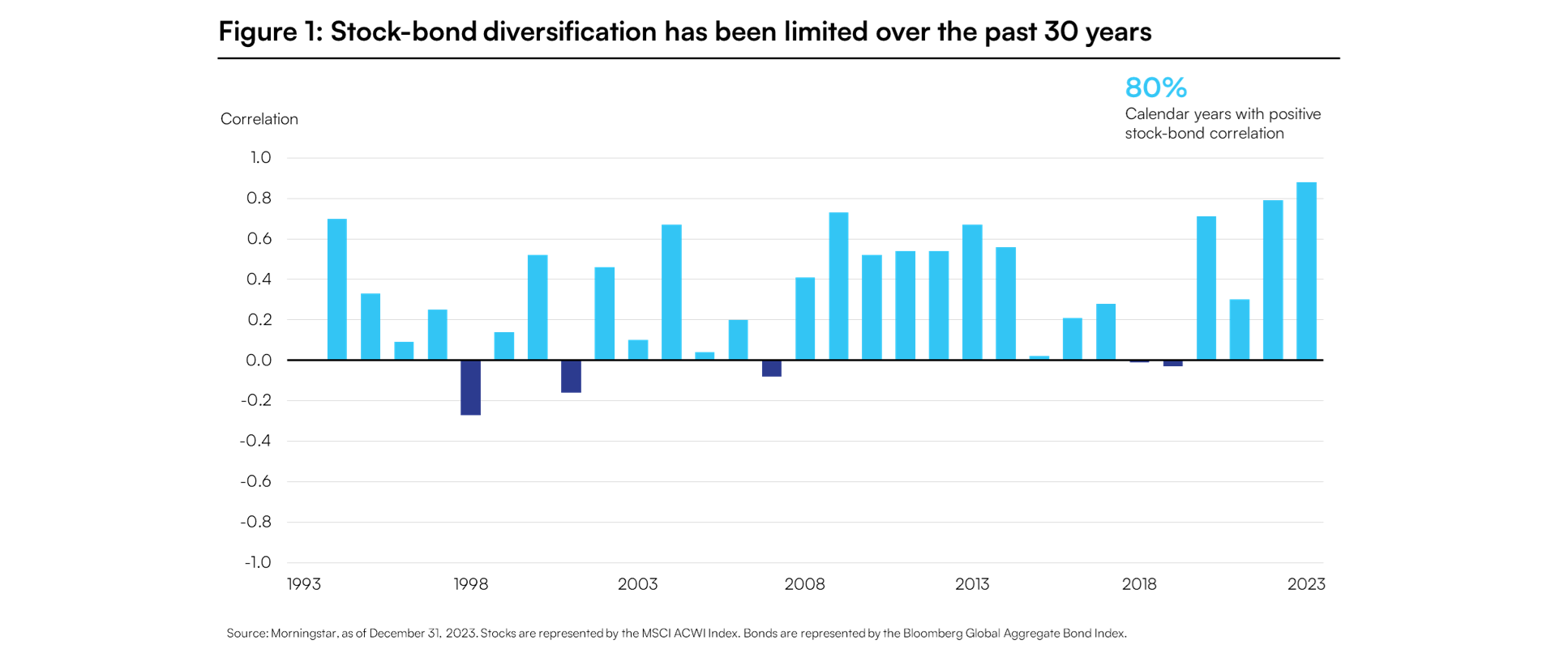

Over the past decades, the diversification power of the traditional 60/40 portfolio has weakened as stock-bond correlations have trended higher (see figure 1). When both asset classes move in the same direction, their ability to offset each other diminishes – leaving portfolios more exposed during market stress.

Traditional asset classes, therefore, have recently not been able to achieve the sought-after balancing effect on financial portfolios. In these new circumstances, investors need to search for new means to strengthen their portfolios. Integrating additional asset classes can restore balance: Increasingly, advisors recommend adding a meaningful Private Markets allocation to enhance both return potential and downside resilience.

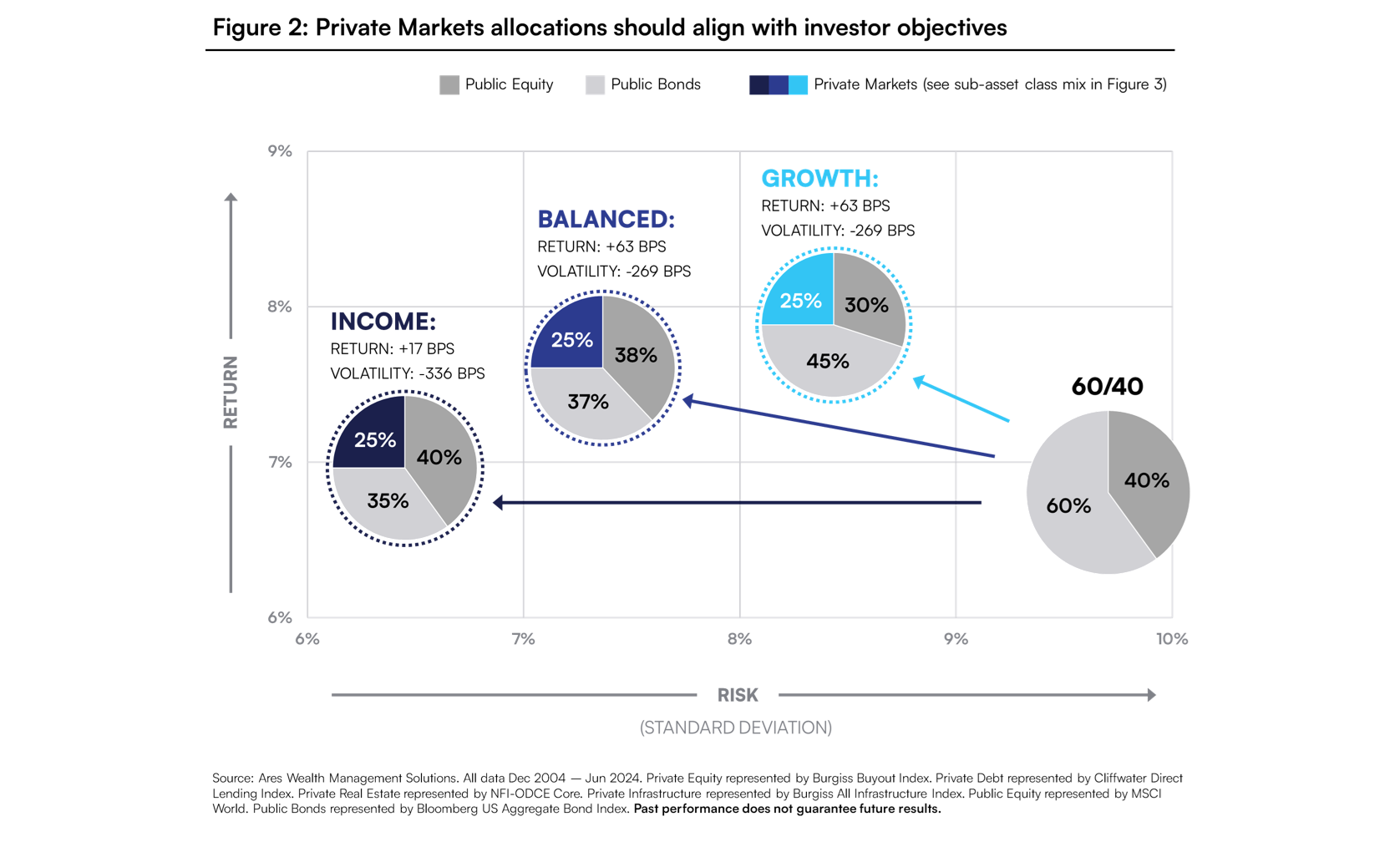

Figure 2 shows how incorporating Private Markets in different ways can strengthen portfolios across three profiles - “Income”, “Balanced”, and “Growth” - each tailored to specific investor objectives: By allocating around 25% of the portfolio to Private Markets, investors can either aim to boost returns while maintaining or even reducing volatility (“Growth”) or lower risk while preserving or enhancing returns (“Income”), whereas a “Balanced” approach reflects a middle ground between the two strategies. Thus, Private Markets can be effectively used to improve portfolio resilience while addressing different investor objectives.

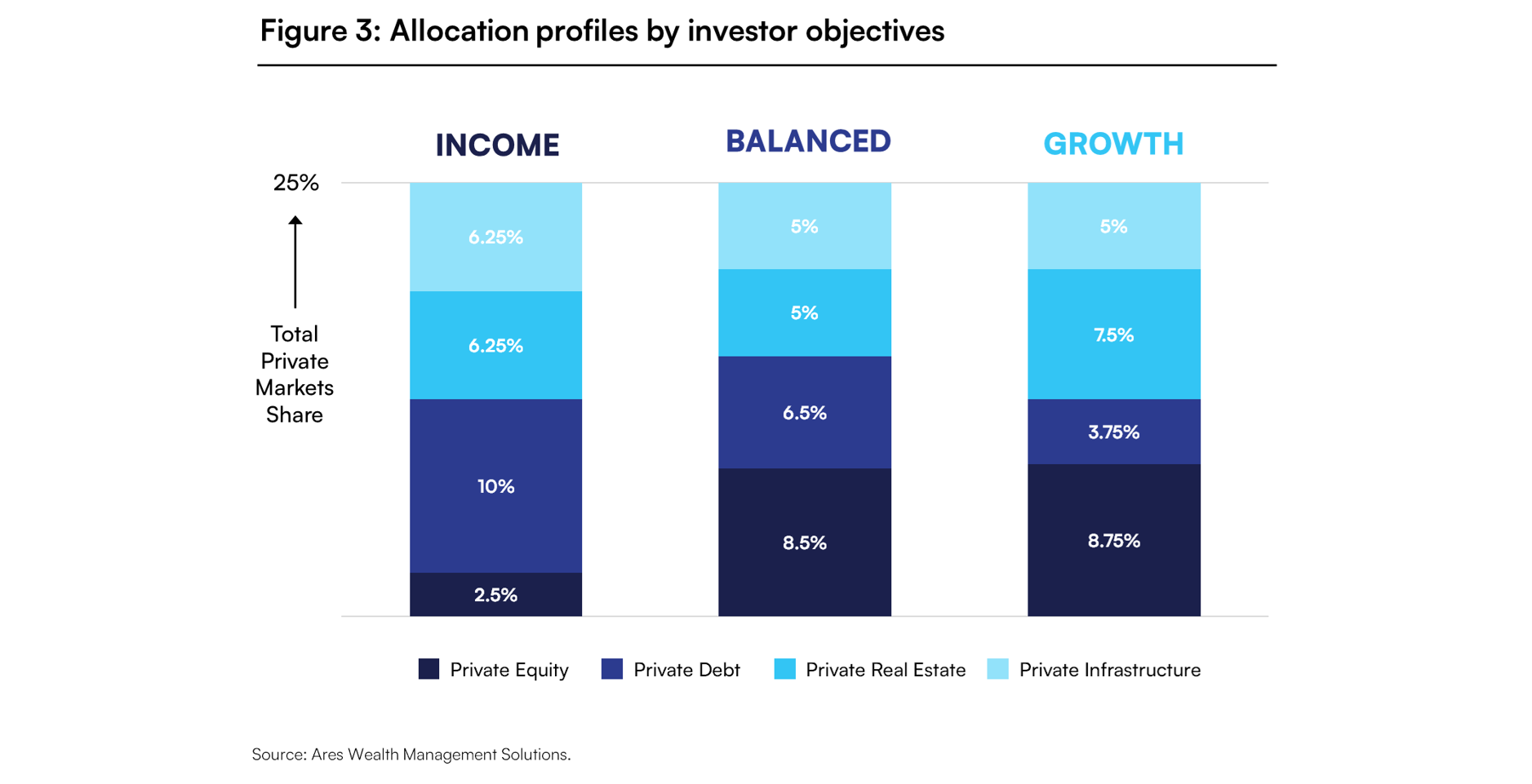

Determining a suitable Private Markets allocation

Investor objectives always represent the starting point for the set-up of financial portfolios. When defining their objectives, investors should consider, among other aspects, their risk appetite, reward expectations, and any potential liquidity requirements – all affecting their target portfolio mix. Once an investor has determined their financial objectives, the next step is to identify the right blend of Private Markets sub-asset classes to match these goals. Figure 3 illustrates how varying proportions of Private Equity, Private Debt, Private Real Estate, and Private Infrastructure investments can be used to target income generation (e.g., through quarterly cash payouts), capital growth (i.e., continuous reinvestment of returns), or a balance of both.

Understanding Private Markets investment structures

Beyond the asset class, investors can also choose from multiple investment structures, each offering distinct benefits and liquidity characteristics:

- Evergreen funds: Perpetual vehicles with periodic subscription (typically monthly) and redemption (typically quarterly) windows. They provide immediate exposure to a diversified portfolio of Private Markets investments (typically covering multiple fund strategies) and automatically reinvest proceeds for compounding returns.

- Closed-ended funds: Fixed-term strategies (typically 10-12 years) where capital is committed into a fund, invested over 3-5 years, and paid back once those assets are sold. With limited to no interim liquidity, managers can invest and exit when conditions are most favorable, often enhancing return potential.

- Direct deals: Investments in single assets (e.g., one individual company). Requiring careful due diligence and providing limited liquidity before a sale, direct deals entail the highest risk for investors – but have the potential to deliver outsized returns and, in some cases, lower costs due to minimal fees.

The “core-satellite” model to Private Markets

Investors can combine all three investment structures into something called a “core-satellite” model. This combination is usually preferred by investors who recognize that each structure has advantages that can be leveraged into a more robust portfolio.

The starting point is to build the core, which might constitute anywhere from 40-70% of the total allocation to Private Markets. The core should be straightforward to establish, diversified, and simple to maintain over time, supporting a long-term investment approach.

Because evergreen funds are open-ended and broadly diversified, they are well-suited cores for private investors.

Then, investors may opportunistically invest in closed-ended funds and/or direct deals. These satellite investments allow investors to target specific sub-asset classes, strategies, and assets, enabling customized portfolio designs (as illustrated in figure 2). With an ambition to have a fully deployed portfolio, satellites could reach up to 30-60% over time.

Using closed-ended funds and direct deals as satellites, investors may target specific investment areas that align with their individual preferences.

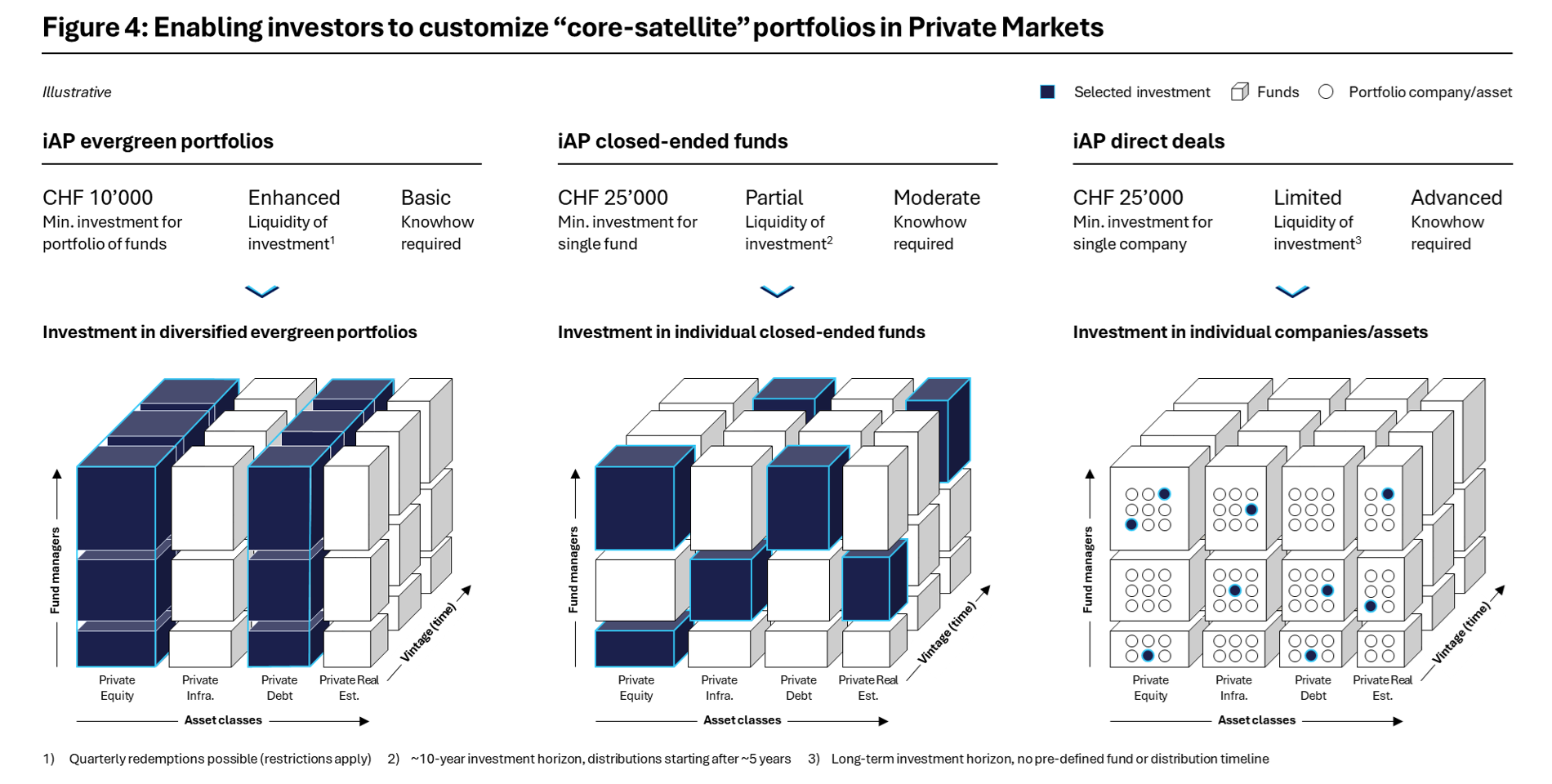

With iAccess Partners, investors can access the full spectrum of Private Markets — from diversified evergreen funds to specialized closed-ended strategies and direct deals (depending on availability) — all within a single platform (see figure 4). This makes it possible for private investors and their advisors to execute institutionally inspired portfolios with efficiency, transparency, and flexibility.

Closing notes

Throughout the last 6 episodes, this series aimed to dive into why Private Markets matter for investors, how barriers for private investors are being eliminated through innovative solutions, and how Private Markets allocations in portfolios can improve overall returns and mitigate volatility. With the right structures and strategy, private investors can now access market-leading Private Markets opportunities once reserved for institutions.

Ready to expand your portfolio? Discuss Private Markets with iAccess Partners

-

Need more information? Contact us!

Reach out to us

Our current investment opportunities

Our investment platform

Log in to view our comprehensive investment offering

Our Evergreen Portfolios

View the details of our Evergreen offering

Would you like to learn more about our fund selection?